Coupon deductions are an industry-wide issue that involves the various roles of the retailer, the manufacturer, the retailer’s agent, the wholesaler and the manufacturer’s agent. Deductions result from payment delays and payment adjustments. Deductions due to payment delays are usually attributable to retailers’ policies, which may require payment in time frames that are shorter than established industry guidelines of 30 days from receipt of invoice. Deductions for payment adjustments occur after the coupon shipments have been processed and paid, and a difference is identified between the “claimed” and “audited” amounts. These adjustments can include:

- Excessive Postage and Shipping Fees

- Count/Value Differences

- Physical Appearance

- Fraud/Misredemption

- Expired / Foreign Coupons

- Claimed Value Over Maximum

- Miscellaneous Handling/Processing Fees

- Unauthorized Coupons

- Erroneous Deductions

- Duplicate

- Wrong Manufacture

- Data Entry Errors

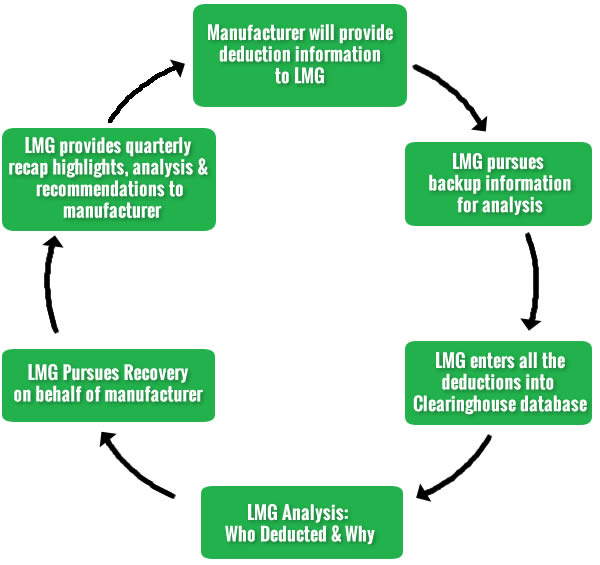

Invoice deductions cost manufacturers hundreds of thousands of dollars. Deductions are difficult for the manufacturer to resolve because the audit trail is usually long and convoluted. L.M. Gordon, Inc.’s efforts are focused on analyzing each deduction and providing manufacturers with the knowledge and pertinent information to address and resolve deduction issues. Our overall goal is to improve operational efficiency and to measurably reduce deductions.

Our program includes critical activities related to:

- Research, Investigation and Reporting of all unauthorized deductions

(We will provide complete details of the deductions processed against your company versus the original invoice.)

- Pursue and Secure Reimbursement

(We will work directly with the deducting entity in a positive and professional manner to obtain repayment of all unauthorized deductions.)

The degree of our efforts will be directly correlated with your company’s overall objective and goal in controlling deductions. Our program will complement your in-house efforts, bringing value to your organization due to our industry knowledge and experience. Additionally, our diverse client base allows us to monitor the deduction practices of your trading partners across all business segments and apply that knowledge in implementing a tailored program to address the respective needs of your company.

Deduction Management & Recovery Program Synopsis

L.M. Gordon Tracking & Reporting

- Deduction Information Control Log

- Manufacturer Deduction Reconciliation Summary

- Retailer Deduction Summary

- Recovery Summary Report

- Ad Hoc Reporting